Checkbook 2 6 2 – Manage Personal Checking Accounts Receivables

Average accounts receivable is the (beginning balance + ending balance)/2. Notelife 1 0 5 – premium note manager resume. The period of time can be a month or a fiscal year. The goal is to increase the numerator (credit sales), while minimizing the denominator (accounts receivable). With CheckBook, easily and simply manage your personal checking accounts. A paper check register can't categorize your transactions or report cash flow over time, and it'll never balance itself. That's where we come in. Introducing CheckBook 2, the powerfully simple personal finance manager. Precisely manage your finances.

- Checkbook 2 6 2 – Manage Personal Checking Accounts Receivables Turnover

- Checkbook 2 6 2 – Manage Personal Checking Accounts Receivables Receivable

- Checkbook 2 6 2 – Manage Personal Checking Accounts Receivables Payable

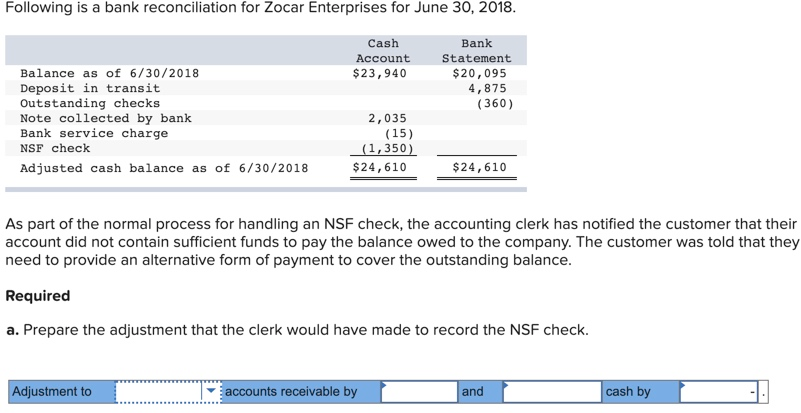

Home Forums General Technology Computer Zone PC Apllications CheckBook Pro 2.6.14 – Manage personal checking accounts Welcome to Ramleague, Ramleague - the best site for pinoy chat, games chat and mobiles chat. To set up a new Checkbook in Bank Reconciliation, follow these steps: 1. Post all transactions in Payables Management, Receivables Management, Sales Order Processing, Invoicing and Payroll. Click Cards, click Financial, and then click Checkbook. Select an existing Checkbook and then click to select the Inactive check box. Repeat this step.

As an accounts receivable management professional, you are well aware that there are just not enough hours in the day. Microcut mill operation manual. You’re not alone; we are all constantly looking for ways to become more efficient and more productive so can get more done and in less time. The business world is always evolving and technology is constantly advancing to help us do just that, but how often do you have the time to sit down and read industry magazines, blogs, and articles to learn about them? Probably not very often. Below we’ve compiled some of our most popular accounts receivable white papers and resources so you don’t need to waste your free moments scouring the internet looking for the latest accounts receivable news and trends. These free resources cover a variety of topics on accounts receivable best practices, automation, industry statistics, and more to help companies become more effective and more efficient in their daily activities. Two birds, one stone. Read on to access these white papers and learn about the current state of the industry and latest tools to help you reduce outstanding invoices, do more in less time, and get paid faster.

HOW TO ELIMINATE INVOICE DISPUTES

This white paper includes dispute management strategies for business credit professionals. If you extend credit terms to business customers, you’ll inevitably end up with plenty of reasons why customers can’t or won’t pay you on time. This paper is designed to help you eliminate the reasons why your customers won’t pay you on time, and it has suggestions and strategies for resolving invoice disputes. This paper covers topics including the consequences of invoice disputes, dispute prevention, cash flow problems, non-billing disputes, recommendations, and much more.

17 TIPS FOR REDUCING OUTSTANDING ACCOUNTS RECEIVABLE

There are some fundamental and easily-deployed tactics that are sometimes forgotten in the rigmarole of daily activities – tactics and concepts that every credit department can use to reduce outstanding receivables. This white paper highlights these 17 points with descriptions and suggestions related to implementation of each strategy and examples to illustrate how they can be integrated with manual and automated systems such as credit and collections management (CCM) applications.

COLLECTION LETTER TEMPLATES

A sizeable amount of the day could be spent sending individualized collection letters to every customer. Trying to come up with these on a whim is too difficult. We’ve taken the difficulty out of sending collection letters by creating templates for every step. This white paper includes a template for the first, second and third collection letter and the notice of legal action.

HOW TO DEVELOP A CREDIT POLICY PLAN

The goal for a Credit Plan is to clearly define these elements so that employees conform to documented steps and procedures designed to improve all related business processes. Many companies struggle to formalize policies due to ad-hoc credit management from salespeople, lack of critical financial information, or simply due to time constraints and higher priority projects. When we take time to look around, we suddenly see the importance of developing a formalized credit policy. This document outlines six easy steps to developing a world class credit policy and collections action plan to help you gain significant advantages in your business.

THE ROI OF ACCOUNTS RECEIVABLE SOFTWARE

Accounts receivable software is becoming more and more popular as companies are realizing how much their current business software lacks in this important area. However, those that have yet to invest typically do because they are afraid of the cost. Since cloud technology has become the norm, accounts receivable software has become much more affordable, even for small businesses. This white paper takes a look at the ROI of accounts receivable software, from paper product savings to staffing solutions.

Checkbook 2 6 2 – Manage Personal Checking Accounts Receivables Turnover

HOW TO DEVELOP KILLER A/R COLLECTION LETTERS, CALL SCRIPTS AND EMAIL TEMPLATES

Communication frequency and the quality of those communications play an enormous role in a company’s ability to quickly and effectively collect receivables. https://heremload640.weebly.com/adobe-after-effects-70-professional-for-mac.html. This white paper provides everything you need to consider before you start building out email templates, collection letter templates, and collection call scripts. Sample templates, documents and scripts are provided at the end of this document for examples to get you started. In addition to sample templates, documents and scripts, this document helps you define accounts receivable procedures, set goals, identify invoice problems, measure your results, and more.

CheckBook Pro 2.6.16 macOS

With CheckBook, easily and simply manage your personal checking accounts. How to use compressor 4 4 6 from fcpx.

A paper check register can’t categorize your transactions or report cash flow over time, and it’ll never balance itself. That’s where we come in. Introducing CheckBook 2, the powerfully simple personal finance manager.

Precisely manage your finances:

- Find transactions with simple searches or dozens of powerful criteria

- Reconcile your accounts to the penny

- Schedule transactions that repeat periodically, like monthly bills and paychecks

- Track cash flow over time with customizable reports so you can see where your money came from and where it’s going

Import from other personal finance apps or your bank:

- Strong support for OFX, QFX, QIF, CSV, and Text

- Import from Quicken Essentials for Mac

- Share and sync your dаta:

- Sync with other users on a local network

- Sync with iCloud, when used on OS X Mountain Lion

And more:

- Manage accounts in multiple currencies

- Transfer funds between accounts without creating two transactions

What’s New:

Version 2.6.16:

New Features Importer for contacts 1 5 1000.

- We’ve added new keyboard shortcuts to CheckBook Pro’s date pickers. Try ‘Y’, ‘M’, and ‘D’, for today’s year, month, and day, and don’t forget ’T’ and ‘L’, for today’s date and the last entered date, are already in there. Fixes

- Prevents a crash that can happen if an Entry is dragged in All Accounts.

- Corrects an issue preventing row heights from being recalculated when you change the Entry Font Size preference while the Amount column is hidden.

- Includes minor user interface enhancements.

Compatibility: OS X 10.7.3 or later, 64-bit processor

Homepagehttps://www.splasm.com/checkbook/index.html

Checkbook 2 6 2 – Manage Personal Checking Accounts Receivables Receivable

Screenshots

Checkbook 2 6 2 – Manage Personal Checking Accounts Receivables Payable

Adobe photoshop free trial windows.

Checkbook 2 6 2 – Manage Personal Checking Accounts Receivables

UNDER MAINTENANCE